Each UK Budget brings headlines around tax, incentives, and economic forecasts. But for many mid-market businesses, the most important driver of financial resilience is not found in government policy — it lies within the business itself.

In an environment shaped by rising costs, constrained borrowing, and ongoing uncertainty, working capital management has emerged as the single most powerful lever for stability and growth.

The Budget Context: Relief Is Limited, Pressure Is Not

Recent fiscal measures may provide pockets of short-term relief, but they do little to offset the broader pressures facing mid-sized organisations. Higher wage costs, frozen tax thresholds, and elevated borrowing rates continue to squeeze liquidity.

For finance leaders, this reality shifts the focus away from external support and towards internal financial discipline. The question is no longer “What will the Budget do for us?” but “How effectively are we using the cash already tied up in our business?”

Why Working Capital Is the Real Strategic Lever

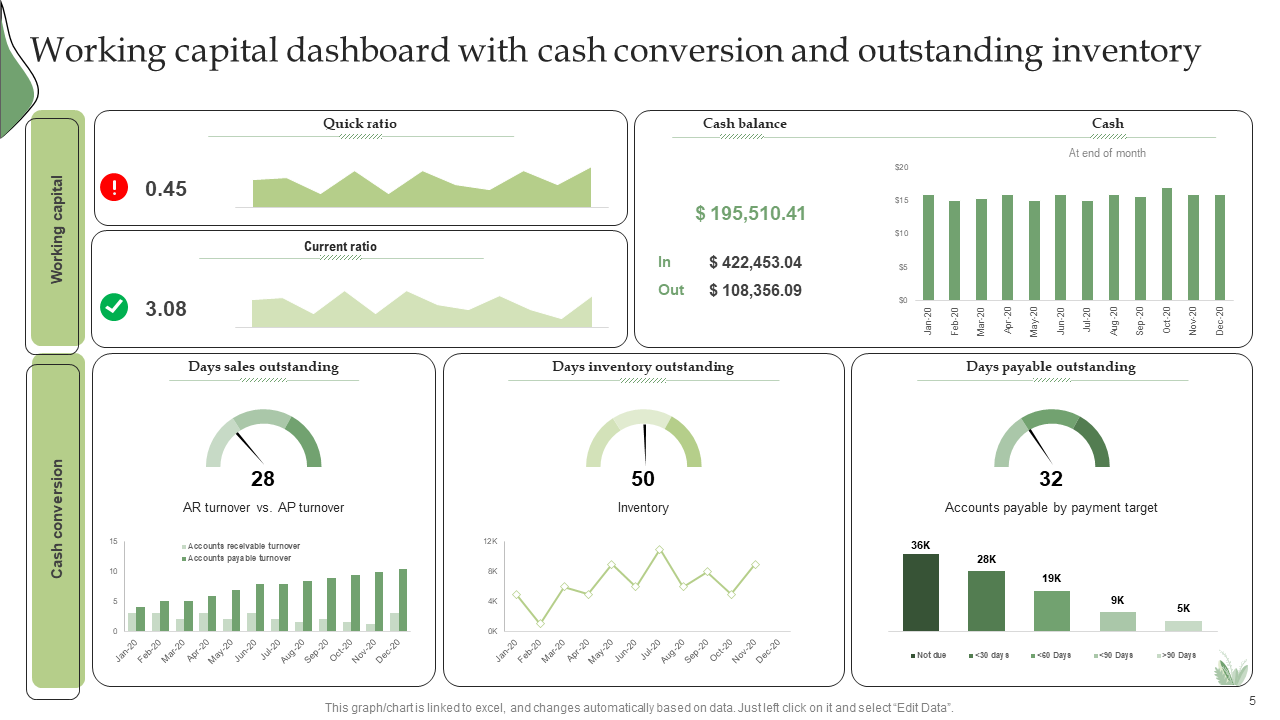

Working capital is often treated as a technical accounting metric. In practice, it is a strategic resource.

Cash locked in receivables, inventory, or inefficient payment processes restricts flexibility. When released and managed deliberately, that same cash can:

-

Strengthen liquidity without new borrowing

-

Improve resilience during economic shocks

-

Fund growth, innovation, and digital investment

For mid-market firms operating with lean finance teams and decentralised decision-making, even small improvements in visibility can unlock meaningful value.

Visibility Across Spend Is Where Change Begins

One of the most common barriers to effective working capital management is fragmented data. When procurement, operations, and finance work in silos, forecasting becomes reactive rather than strategic.

Improving visibility across the full spend lifecycle allows businesses to:

-

Anticipate cash pressure before it arises

-

Negotiate supplier terms with confidence

-

Align operational decisions with liquidity priorities

Connected systems and shared accountability across teams are essential. Working capital is not owned by finance alone — it is shaped daily by purchasing, inventory, and payment decisions across the organisation.

Technology as an Enabler, Not a Shortcut

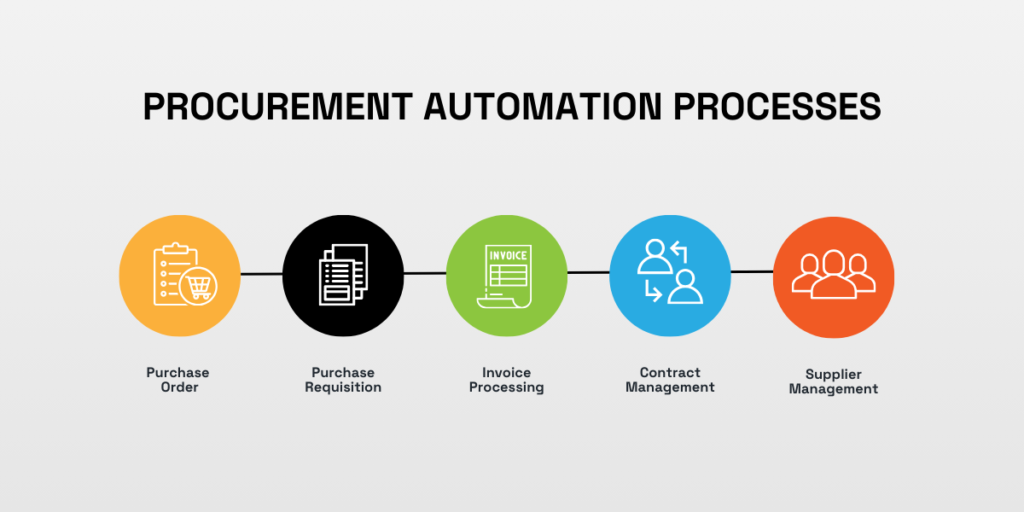

Technology plays a critical role, but only when paired with clear process design. Integrating ERP, procurement, and payment systems improves accuracy and provides real-time insight into commitments and cash flow.

However, systems alone are not a solution. Without alignment between teams and clear ownership, even the most advanced platforms fail to deliver expected benefits.

When implemented thoughtfully, automation reduces friction, improves forecasting accuracy, and gives leadership teams the confidence to deploy working capital strategically rather than defensively.

Building Internal Resilience in an Uncertain Economy

Economic conditions will continue to shift, and policy support will fluctuate. These factors sit largely outside a business’s control.

What is controllable is how efficiently cash moves through the organisation.

Mid-market businesses that prioritise working capital discipline — supported by strong data, aligned teams, and informed decision-making — are better positioned to withstand volatility and act decisively when opportunities arise.

Final Thoughts: Cash Is Not Passive

Working capital is not a static balance-sheet figure. It is an active, strategic tool that can strengthen resilience regardless of the economic climate.

Businesses that understand this move beyond survival mode. They gain confidence, flexibility, and the capacity to invest in their future without over-reliance on external funding.

At Ten Piece Limited, we help businesses turn working capital from an afterthought into a strategic advantage — delivering clarity, control, and confidence in uncertain times.