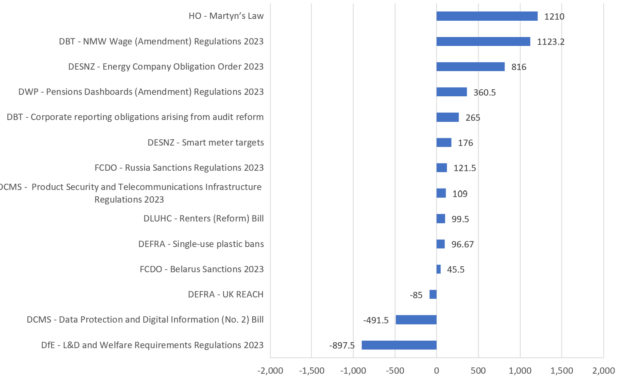

The UK has long been viewed as a stable and trusted place to do business. Yet for many small and mid-sized organisations, regulation increasingly feels less like protection and more like pressure.

The challenge facing businesses today is not one single rule or reform, but the cumulative weight of overlapping, fragmented requirements. As regulatory complexity grows, so does the cost of compliance — not just financially, but in time, confidence, and momentum.

When Regulation Becomes a Growth Constraint

For SMEs, compliance rarely arrives in neat packages. Tax changes, data protection obligations, employment rules, reporting requirements, and emerging technology regulation often land simultaneously — each managed by a different authority.

Individually, these rules may be reasonable. Collectively, they can:

-

Drain management time

-

Lock up capital in administration

-

Delay hiring, investment, and innovation

The result is a form of slow friction — where growth is constrained not by market demand, but by the sheer effort required to stay compliant.

The Case for a More Joined-Up Approach

Effective regulation should create confidence, not confusion. A joined-up approach recognises that businesses experience regulation as a single ecosystem, not as isolated rulebooks.

Smarter regulation focuses on:

-

Eliminating duplication across agencies

-

Updating outdated requirements that no longer serve their purpose

-

Ensuring new rules integrate cleanly with existing frameworks

When regulation is designed holistically, compliance becomes more predictable, less costly, and easier to embed into everyday business operations.

Why SMEs Feel the Impact First

Large organisations often absorb regulatory change through specialist teams and systems. Smaller businesses do not have that luxury.

For SMEs, every new requirement competes directly with core activities — winning clients, managing cash flow, and delivering services.

This makes regulatory overload particularly damaging at the very stage when businesses should be scaling.

Without simplification and coordination, there is a real risk that regulation discourages entrepreneurship rather than supporting it.

Data, Technology, and the Risk of Fragmentation

In a digital economy, businesses are often asked to submit the same information multiple times, in slightly different formats, to different bodies. This duplication is inefficient and avoidable.

As new rules emerge — particularly around technology and data — the danger is not regulation itself, but regulation built in silos.

If systems don’t talk to each other, compliance costs rise and innovation slows.

A more coordinated regulatory model would reduce duplication, improve data accuracy, and lower the administrative burden across the board.

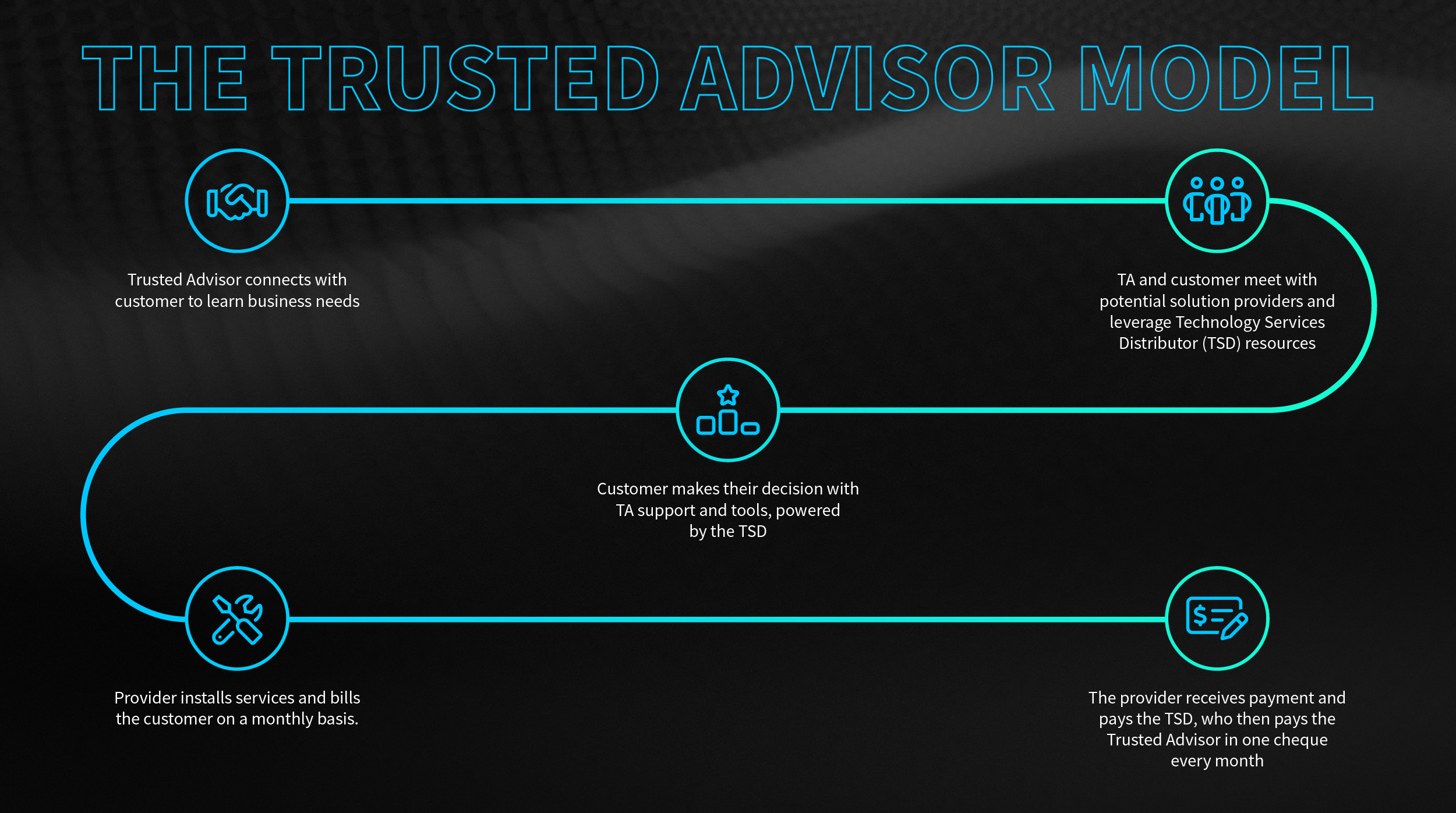

The Role of Accountants as Navigators

As regulation becomes more complex, accountants are playing an increasingly important role — not just as compliance processors, but as navigators of the regulatory landscape.

By helping businesses interpret requirements, streamline reporting, and plan ahead, accountants turn regulatory challenge into manageable structure.

The focus shifts from reacting to rules, to building systems that absorb change without disruption.

Final Thoughts: Regulation That Supports, Not Suffocates

Regulation is essential for trust, transparency, and market confidence. But when it becomes fragmented or outdated, it risks undermining the very businesses it is meant to protect.

A smarter, more holistic approach — one that simplifies, coordinates, and modernises — would allow UK businesses to focus on growth rather than survival.

At Ten Piece Limited, we help businesses stay compliant while keeping sight of the bigger picture — using clear systems, practical advice, and proactive planning to ensure regulation becomes a framework for confidence, not a barrier to progress.