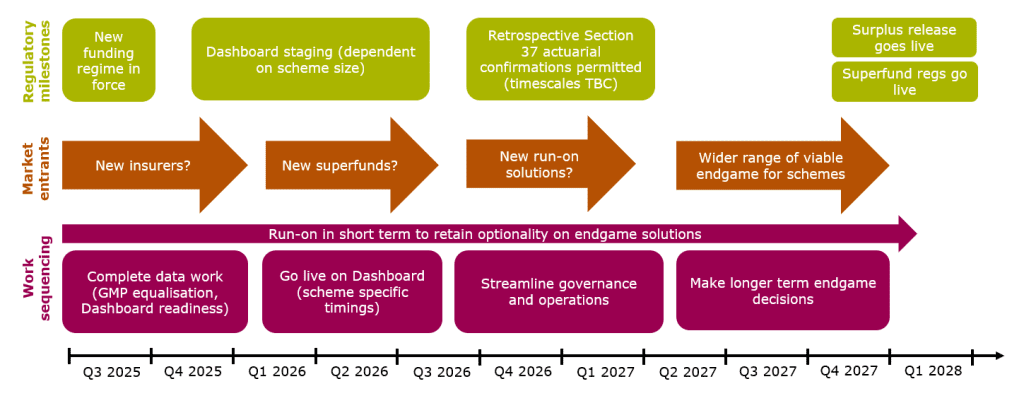

The UK pensions sector is entering a period of fundamental change. Regulatory reform, consolidation, and growing expectations around transparency are reshaping what “good” looks like across pension schemes and fund administration.

As the system evolves, the focus is shifting away from size alone and towards outcomes, accountability, and operational resilience. For firms operating in or alongside the pensions space, the coming years will demand more than compliance — they will demand readiness.

Consolidation Is Reshaping the Market

A clear direction of travel is emerging across the pensions industry: scale will be rewarded, fragmentation will not. Smaller pension pots are increasingly being consolidated into larger, value-tested schemes, accelerating structural change across defined contribution arrangements.

This consolidation brings opportunity, but also scrutiny. Firms involved in administration and oversight must be able to demonstrate that their systems, processes, and data can operate effectively at scale — without sacrificing control or accuracy.

Those unable to adapt risk falling behind as the market favours operators that can support larger, more complex structures with confidence.

From Efficiency to Evidencing Value

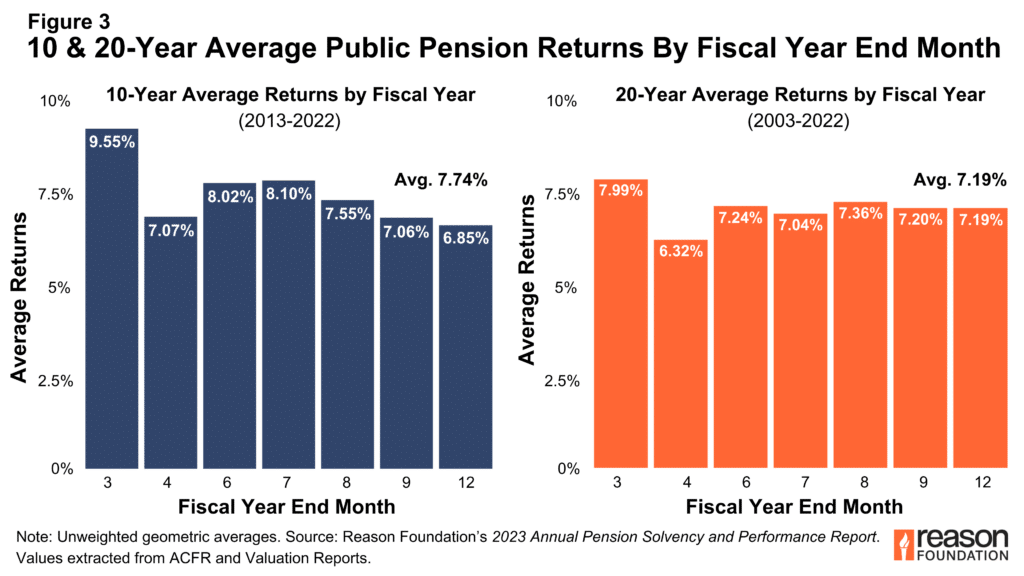

Historically, operational success in fund administration was measured by efficiency — doing the same work faster and at lower cost. That definition is changing.

The emphasis is now on evidencing value. Cost remains important, but it is no longer sufficient on its own. Firms must show how their operations contribute to better outcomes, stronger governance, and clearer reporting for members and regulators alike.

This requires data that is accurate, connected, and capable of standing up to independent scrutiny — particularly as investment structures become more complex.

Data and Automation as the Foundations of Resilience

As pension schemes grow in size and complexity, legacy systems are being pushed beyond their limits. Fragmented data, manual reconciliations, and spreadsheet-driven workflows create operational risk that is increasingly unacceptable.

Modern operating models rely on:

-

Standardised data structures that allow consistency across funds

-

Automation of complex processes, reducing error and dependency on manual intervention

-

Integrated systems where accounting, valuation, and reporting draw from a single source of truth

When implemented well, automation doesn’t remove human judgement — it enhances it, freeing professionals to focus on oversight, investigation, and decision-making rather than administration.

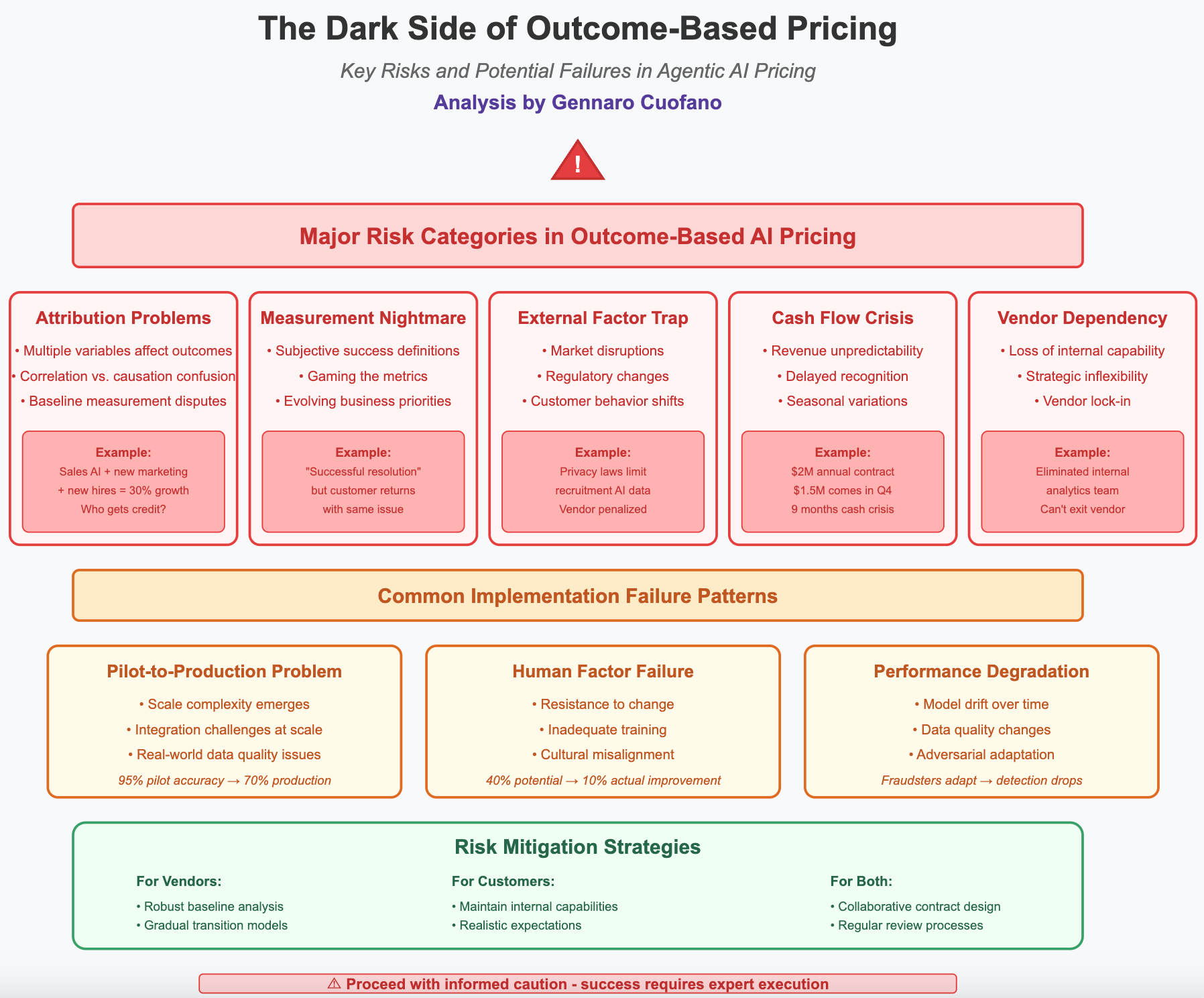

Preparing for an Outcome-Driven Future

The future of pensions administration is outcome-driven. Regulators, trustees, and members increasingly expect transparency, comparability, and clarity — not just compliance.

This places new demands on operational design. Firms must balance:

-

Scale with accountability

-

Efficiency with auditability

-

Flexibility with control

Those that invest early in resilient systems and robust data models will be better positioned to participate in larger schemes, support private market exposure, and meet rising expectations without increasing operational risk.

Final Thoughts: Operational Strength as a Competitive Advantage

The transformation of the UK pensions landscape is not a distant prospect — it is already underway. As consolidation accelerates and accountability deepens, operational readiness will become a defining factor in long-term success.

Firms that treat this moment as an opportunity to modernise — rather than a challenge to endure — will emerge stronger, more resilient, and more trusted.

At Ten Piece Limited, we help organisations build the financial clarity, systems, and advisory capability needed to thrive in regulated, outcome-driven environments — turning structural change into strategic advantage.