As businesses look ahead to 2026, uncertainty is no longer a short-term disruption — it is the operating environment. Persistent inflation, shifting regulations, evolving technology, and fragile supply chains are redefining how organisations plan, invest, and grow.

While these pressures can feel overwhelming, they also present an opportunity. Firms that prepare early and respond strategically can turn uncertainty into a competitive advantage.

Why Resilience Has Become a Financial Priority

Resilience is no longer just about surviving shocks. It is about building systems that allow a business to anticipate change, absorb disruption, and adapt quickly.

From a financial perspective, this means:

-

Strong cash flow visibility

-

Robust cost control

-

Forward-looking planning rather than reactive reporting

In an environment where growth is subdued and costs remain elevated, businesses that lack financial clarity are more exposed to risk. Resilient organisations, by contrast, use financial insight to make confident decisions even when conditions are volatile.

The Expanding Role of Finance and Accounting

Modern finance teams are no longer confined to historical reporting. Their role has expanded into strategic navigation — helping leadership teams understand what lies ahead, not just what has already happened.

This includes:

-

Monitoring external risks and regulatory changes

-

Stress-testing forecasts under different scenarios

-

Identifying vulnerabilities before they become problems

Accountants and advisors now sit at the centre of business resilience, translating complexity into practical guidance that supports stability and growth.

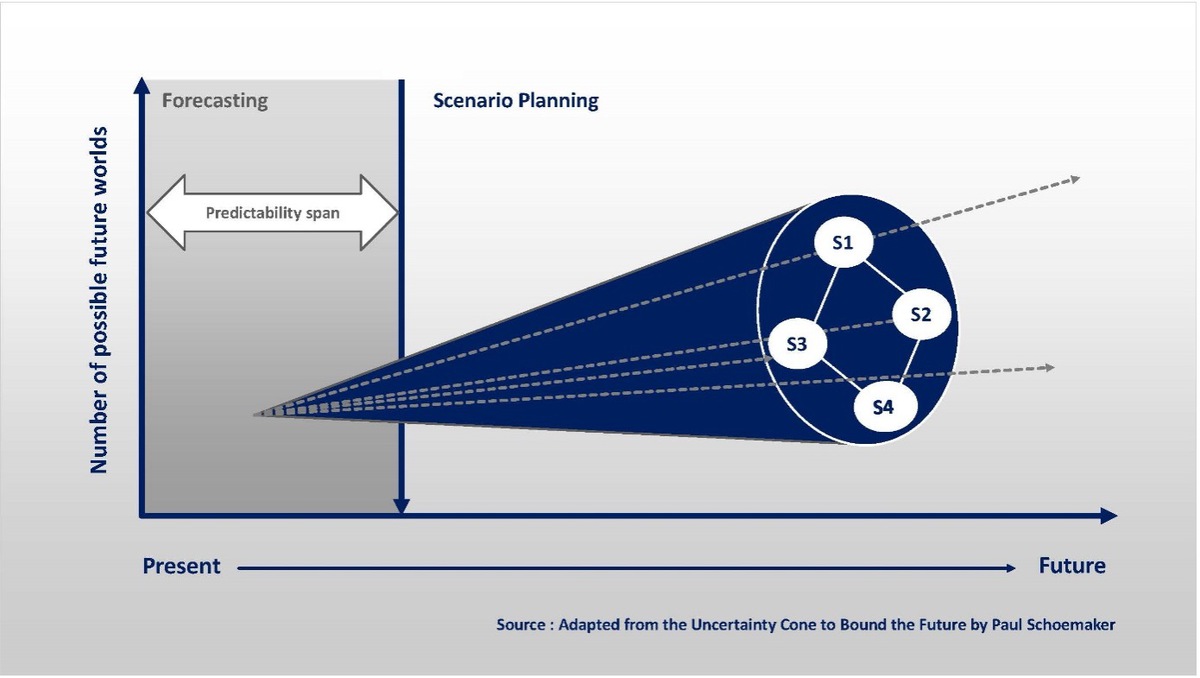

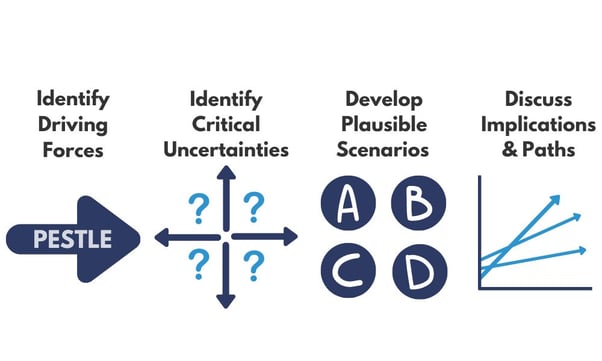

From Forecasting to Scenario Planning

Traditional forecasting assumes a relatively stable environment. In contrast, scenario planning recognises that multiple futures are possible.

By modelling different outcomes — such as cost increases, demand shifts, supply disruption, or regulatory change — businesses can:

-

Test how resilient their finances really are

-

Prepare contingency plans in advance

-

Make faster, more confident decisions when disruption occurs

This approach transforms uncertainty from a threat into something manageable.

Cost Control Without Cutting Capability

In periods of pressure, the instinct is often to cut costs aggressively. However, resilience is not built through indiscriminate reduction.

Sustainable cost control focuses on:

-

Improving efficiency through better data and systems

-

Removing waste without undermining capability

-

Protecting investment in areas that drive long-term value

When handled correctly, cost discipline can free up resources for innovation, digital improvement, and strategic investment — strengthening the business rather than weakening it.

Building Flexibility Into the Business Model

Resilient businesses are adaptable by design. They review pricing models, supplier relationships, and operating structures regularly to ensure they can respond to change.

This may involve:

-

Diversifying suppliers

-

Reviewing pricing and margin assumptions

-

Using management information to adjust quickly

Flexibility allows businesses not just to withstand disruption, but to identify opportunities that less-prepared competitors may miss.

Final Thoughts: Turning Uncertainty Into Advantage

Uncertainty is not going away — but vulnerability is optional.

Businesses that invest in financial clarity, forward planning, and strong advisory support are far better placed to navigate the years ahead. Resilience is no longer a defensive concept; it is a strategic one.

At Ten Piece Limited, we help businesses build that resilience — through robust accounting systems, meaningful management information, and proactive advisory support that turns uncertainty into informed action.