For many UK businesses, 2026 may feel comfortably distant. In accounting terms, however, it is right around the corner.

Significant changes to FRS 102 are approaching, and they will fundamentally alter how many businesses present their financial position. These updates are not cosmetic. They will reshape balance sheets, affect reported profitability, and potentially influence lending decisions long before the first set of revised accounts is filed.

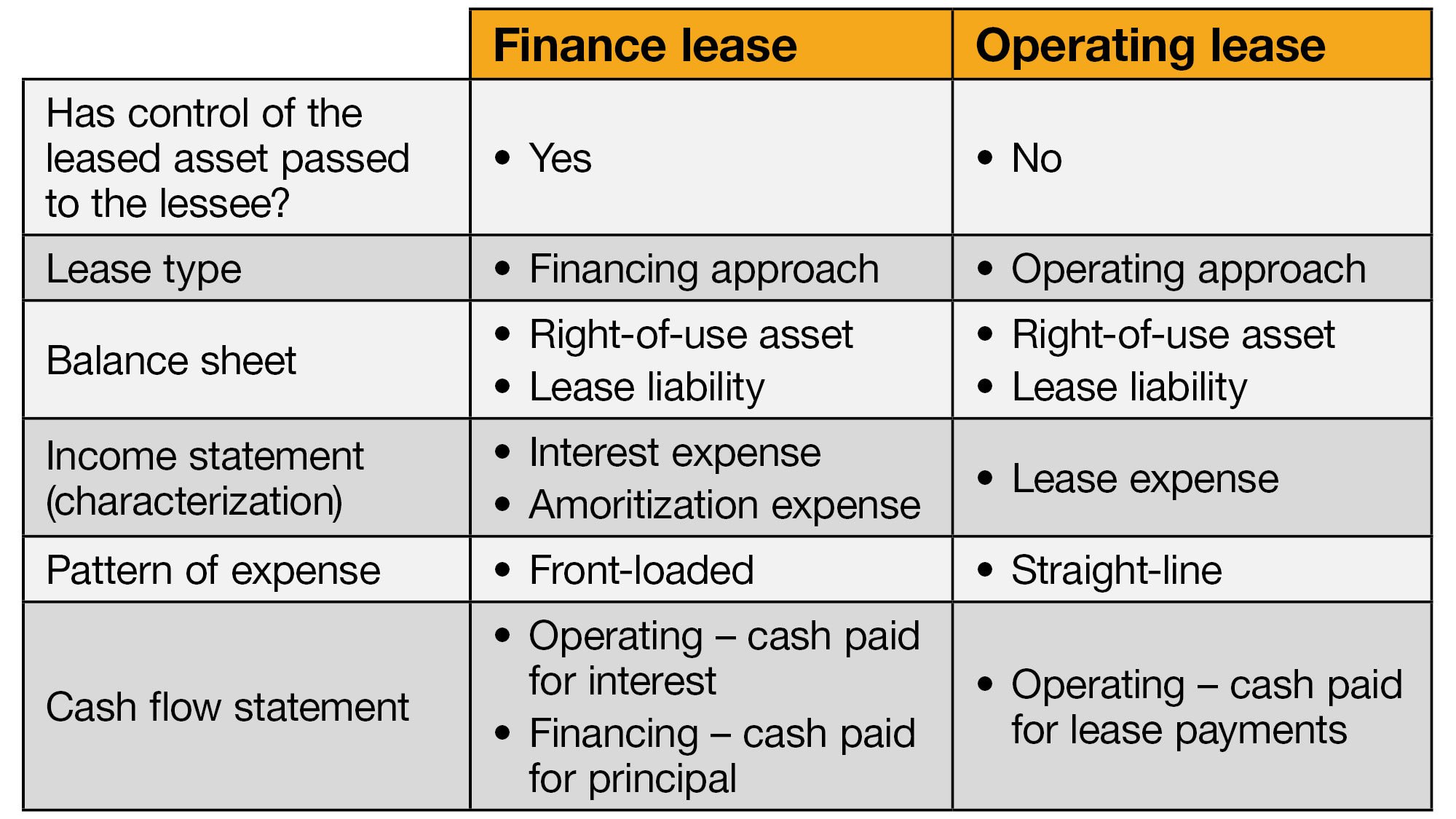

Lease Accounting Is About to Look Very Different

One of the most impactful changes relates to lease accounting. Arrangements that previously sat quietly off the balance sheet will soon be brought firmly into view.

Under the revised approach, most leases will give rise to:

-

A recognised right-of-use asset, and

-

A corresponding lease liability

For businesses that rely heavily on property, vehicles, or equipment leases, this will result in a noticeable expansion of the balance sheet — even though cash flows remain unchanged.

The accounting presentation will shift, but the commercial consequences could be very real.

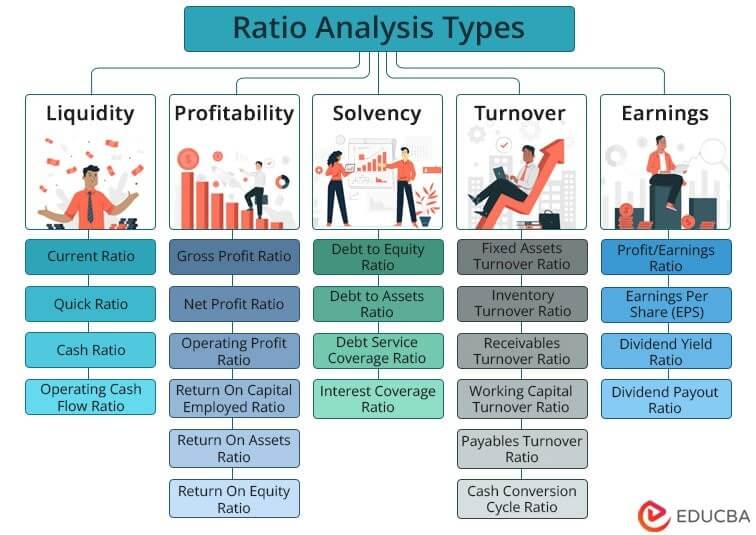

The Knock-On Effect for Key Financial Metrics

When new liabilities appear on the balance sheet, financial ratios change automatically. Gearing increases. EBITDA calculations shift. Profit profiles can become more front-loaded due to the way depreciation and interest are recognised.

For some businesses, this could:

-

Push gearing ratios beyond lender comfort zones

-

Trigger covenant discussions

-

Affect perceptions of financial strength among stakeholders

Crucially, none of this reflects a deterioration in the underlying business. But accounting numbers shape decisions, and those decisions are often made by banks, investors, and counterparties who rely on reported figures.

Why Early Planning Matters More Than Ever

The most significant risk surrounding the 2026 changes is not the technical complexity — it is late engagement.

Businesses that wait until implementation will be forced into reactive conversations with lenders and stakeholders. Those that act early can model the impact, explain changes clearly, and renegotiate terms from a position of control rather than urgency.

This is where accounting shifts from compliance to advisory. Understanding how future standards affect today’s decisions allows businesses to manage expectations and protect commercial relationships.

Data Readiness Is the Hidden Challenge

Before any calculations can take place, businesses need clarity on their lease arrangements — and that is often harder than it sounds.

Agreements may be scattered across systems, emails, or paper files. Terms such as renewal options, break clauses, and variable payments all affect measurement and must be identified accurately.

Getting organised now avoids rushed assumptions later and ensures that financial reporting reflects reality rather than estimates made under pressure.

Turning a Reporting Change into a Strategic Advantage

While the upcoming changes will require effort, they also create an opportunity.

Businesses that understand their lease commitments in detail gain better insight into long-term cost structures, operational flexibility, and financing exposure. That knowledge can support better decisions around property strategy, investment, and funding.

Handled well, the 2026 changes become a catalyst for stronger financial discipline — not just a compliance exercise.

Final Thoughts: Accounting Changes That Demand Commercial Thinking

FRS 102 is evolving, and the impact will extend well beyond the accounting function.

For UK businesses, the challenge is not simply to comply, but to understand what the numbers will say — and how others will interpret them. Preparation, modelling, and clear communication will separate those who manage the transition smoothly from those caught off guard.

At Ten Piece Limited, we help businesses anticipate change rather than react to it — combining technical expertise with practical, commercial insight to ensure accounting developments support confident decision-making.