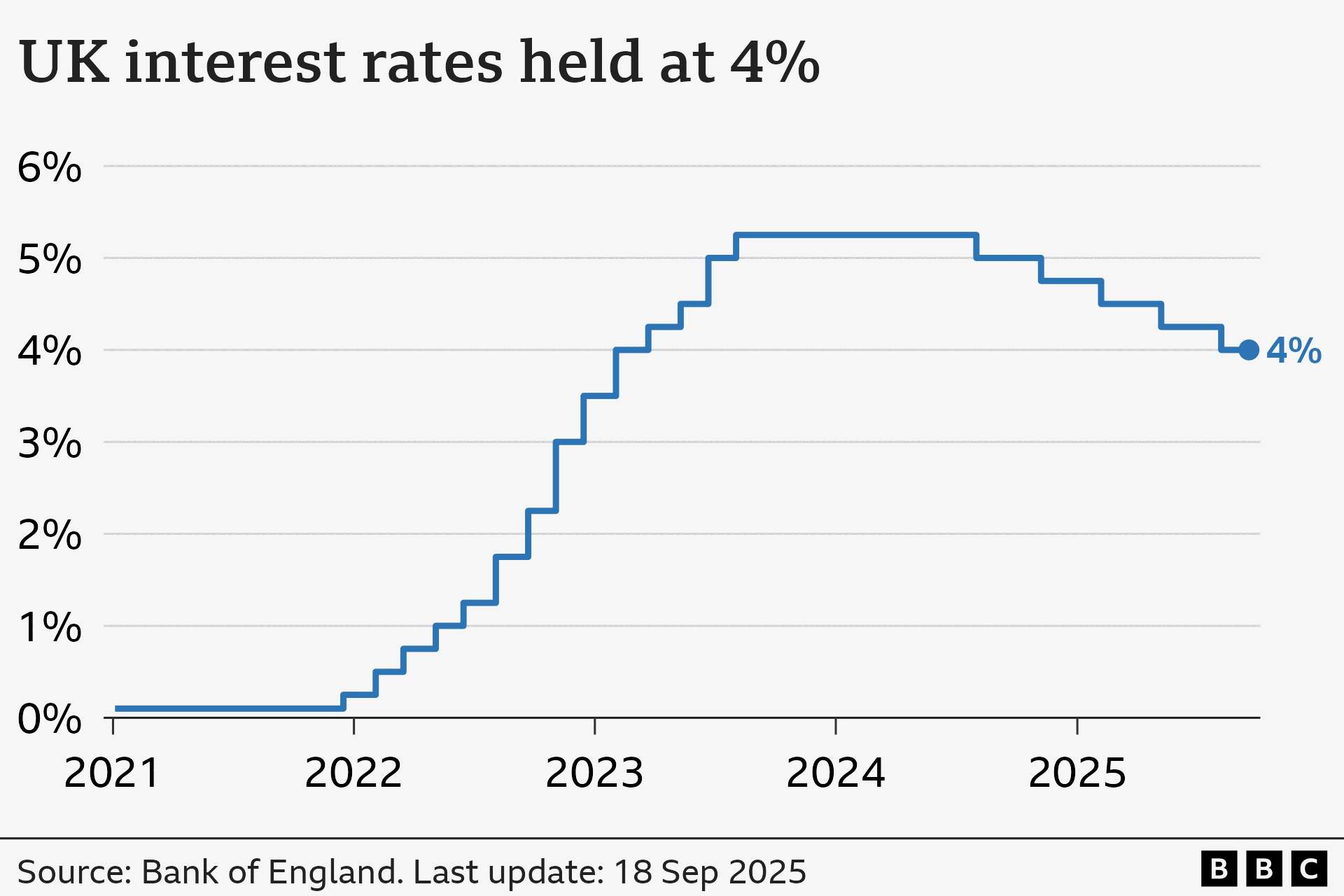

On 19 September 2025, the Bank of England confirmed that it will keep its base interest rate steady at 4%. This decision follows months of speculation about whether rates would rise again in response to persistent inflationary pressures.

Why the Decision Matters

By holding rates, the Bank of England signals a cautious approach to balancing economic growth with inflation control. While higher rates typically help cool inflation, they also increase borrowing costs for households and businesses. Read the full statement from the Bank of England (https://www.bankofengland.co.uk).

Wider Industry Headlines

Alongside the rate announcement, HMRC has flagged five UK accountancy firms for promoting tax avoidance schemes. Businesses and individuals are reminded to seek trusted, compliant advice to avoid large tax bills, interest charges, and penalties. HMRC guidance on tax avoidance schemes (https://www.gov.uk/guidance/tax-avoidance-an-introduction).

Other recent updates in the accountancy sector include:

-

Client experience challenges – research highlights how poor onboarding and communication cost firms millions.

-

Sustainability rules – ACCA backs voluntary UK frameworks on assurance.

- Sector restructuring – Deloitte mulls job cuts as part of an internal review.

What This Means for You

-

SMEs: Stable rates mean predictable loan repayments, but careful cashflow planning remains essential.

-

Accountants & Advisors: Clients will be looking for reassurance, especially around compliance and tax risk.

-

Investors: Market confidence may rise on signs of stability, though caution remains key.

Final Thoughts

The Bank of England’s decision to hold rates at 4% underscores a wait-and-see strategy. For businesses and professionals alike, the key takeaway is clear: stability today doesn’t guarantee stability tomorrow.

📌 If you need tailored advice on cashflow, tax planning, or compliance, our team at (https://tenpiece.co.uk/) can help.