The start of 2026 is proving to be one of the most dynamic periods for UK accounting professionals in years. Recent surveys signal weaker business confidence and falling hiring, while key regulatory reforms such as Making Tax Digital for Income Tax continue to reshape compliance expectations. Taken together, these developments underscore a clear message: firms that combine regulatory readiness with strategic insight will thrive — and those that don’t may struggle.

Business Confidence Is Falling — What It Means for Practices

At the end of 2025, major surveys found that UK business confidence declined significantly, with hiring dropping as firms pulled back in a cautious climate. Rising costs and economic uncertainty were key drivers, and this hesitancy appears set to continue into 2026.

For accounting practices, this trend has multiple implications:

-

Clients may delay investment or expansion plans, reducing demand for advisory support tied to growth activities.

-

Smaller businesses could prioritise cost control over new engagements, dampening revenue prospects.

-

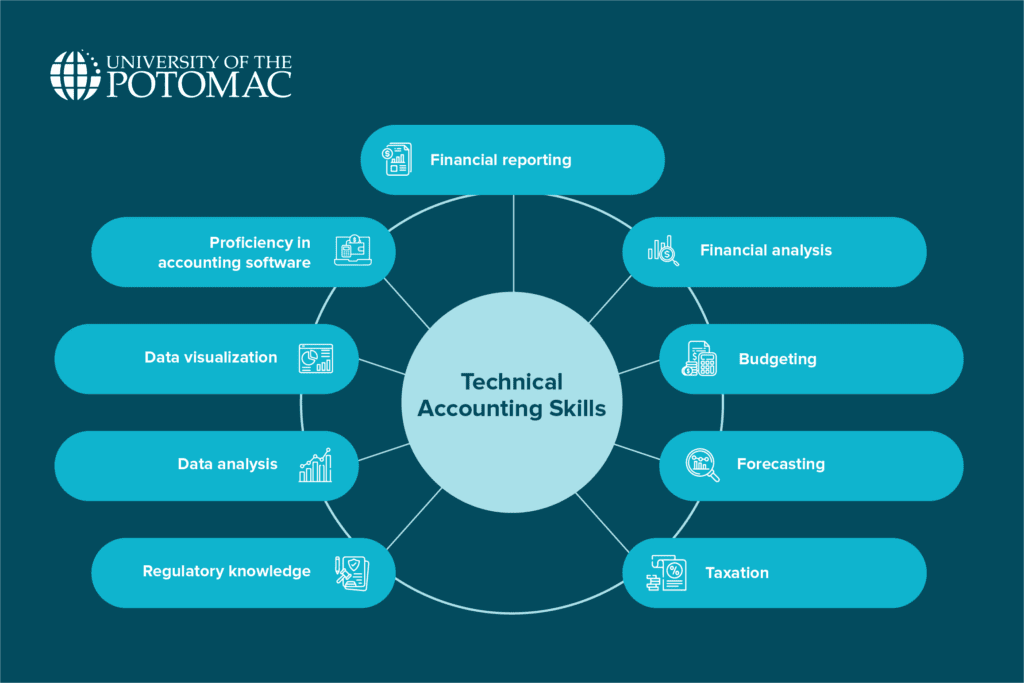

Firms may need to shift focus toward cash flow management, forecasting, and efficiency services, which become priorities in tightening conditions.

In other words, while confidence contracts, the need for trusted financial guidance grows.

‘MTD for Income Tax’ Readiness Remains Low — Early Action Is Competitive Advantage

From April 6, 2026, HMRC will begin mandating quarterly digital reporting for self-employed taxpayers and landlords with income over £50,000, with lower thresholds following in subsequent years. Despite the clear timeline and scope, experts warn that awareness and preparedness among affected taxpayers remain alarmingly low.

This creates a practical challenge — and an advisory opportunity — for practices:

-

Many clients may not be familiar with approved software requirements or digital bookkeeping expectations.

-

HMRC itself has acknowledged implementation challenges by waiving penalties during the first year.

-

Incorrect preparation could result in rushed compliance later and weakened client confidence.

Firms that equip their clients early — with software selection, ongoing record management, and clear quarterly update processes — differentiate themselves as strategic partners rather than simply compliance executors.

Regulation and Reputation: Opinion from the Profession

In another notable development, UK accounting firms — from the Big Four to influential mid-tier players — have publicly urged the Financial Reporting Council (FRC) to end its “name and shame” practice for audit investigations.

This debate highlights a broader industry concern: the balance between transparency and reputational risk. While regulatory disclosure can enhance investor confidence, the coordinated pushback reflects how early public identification — before findings are concluded — may unfairly harm firms and audit partners. The conversation around reform indicates a profession increasingly vocal about how regulation should interact with business reality.

For accounting practices, these debates serve as a reminder that professional standards and regulatory engagement remain central to the profession’s future positioning.

Final Thoughts: A Year of Transition and Opportunity

The UK accounting landscape in 2026 combines challenge with opportunity. Weakening business confidence and rolling compliance deadlines could easily overwhelm practices that respond passively.

But firms that adopt a proactive, strategic stance — alert to regulatory shift, focused on resilient advisory services, and committed to client readiness — will be better positioned to grow even in uncertain conditions.

At Ten Piece Limited, we help practices and their clients navigate these evolving priorities with a blend of regulatory insight, operational planning, and strategic foresight — turning transition into advantage.